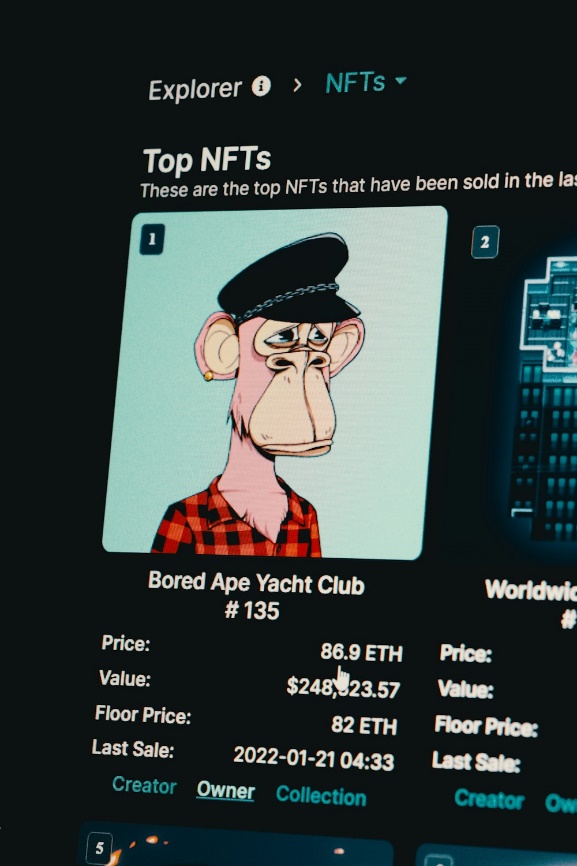

In the rapidly evolving world of digital assets, non-fungible tokens (NFTs) have emerged as a revolutionary concept, transforming how we perceive ownership and value of digital collectibles.

However, the high cost of many NFTs has created barriers to entry for a broad audience. NFT fractionalization addresses this issue by democratizing access to these assets, enhancing liquidity, and broadening market participation.

With the guidance of digital asset consulting experts, this blog explores the mechanics of NFT fractionalization, its use cases in art investment and gaming, and its implications for market accessibility.

Understanding NFT Fractionalization

NFT fractionalization involves dividing an NFT into smaller, more affordable fractions, allowing multiple investors to own a piece of a high-value digital asset. This process is facilitated by smart contracts on blockchain platforms, ensuring transparency and security.

Mechanics of Fractionalization

- Smart Contracts: Smart contracts are deployed to divide the NFT into fungible tokens representing fractions of the original asset. Each fraction retains the properties and value of the underlying NFT.

- Tokenization: The NFT is tokenized into ERC-20 or similar tokens, which can be traded on various decentralized exchanges (DEXs), providing liquidity.

- Ownership and Governance: Fractional owners may have voting rights on certain decisions related to the NFT, such as selling the entire asset or managing its usage.

Use Cases in Art Investment and Gaming

Art Investment

Art investment has traditionally been the domain of the wealthy, but NFT fractionalization is changing this paradigm. High-value digital artworks can be divided into fractions, enabling a broader audience to invest in and benefit from art appreciation.

- Democratizing Access: By lowering the financial barrier, fractionalization allows art enthusiasts and small investors to own a part of prestigious digital art pieces. The market for NFTs was worth a staggering $41 billion in 2021 alone, nearing the total value of the global fine art market.

- Enhanced Liquidity: Fractional NFTs can be traded on DEXs, providing liquidity to an otherwise illiquid asset class. This opens up new opportunities for investors to buy and sell art fractions as market conditions change.

Gaming

The gaming industry is another area where NFT fractionalization is gaining traction. In-game assets, such as rare items or virtual real estate, can be fractionalized, making them accessible to a larger player base.

- Shared Ownership: Gamers can co-own valuable in-game assets, enhancing their gaming experience and investment opportunities.

- Community Engagement: Fractional ownership fosters a sense of community and shared interest among gamers, driving engagement and collaboration within the gaming ecosystem.

Implications for Liquidity and Market Accessibility

Liquidity Enhancement

One of the primary benefits of NFT fractionalization is the significant boost in liquidity. By converting high-value NFTs into tradable fractions, the market becomes more dynamic and accessible. The global NFT market cap stands at $84.21 billion as of 6th July 2024, underscoring the vast potential for growth and liquidity enhancement.

- Increased Trading Volume: Fractional NFTs can be traded more frequently and in smaller denominations, increasing overall market activity and liquidity.

- Price Discovery: Enhanced liquidity facilitates better price discovery, as more participants can buy and sell fractions, reflecting true market value.

Market Accessibility

Fractionalization democratizes access to NFTs, allowing a wider range of investors to participate in the market. The NFT market worldwide is projected to grow by 9.10% from 2024 to 2028, resulting in a market volume of $3.37 billion in 2028, highlighting the increasing accessibility and interest in NFTs.

- Lower Entry Barriers: Investors with limited capital can still participate in the NFT market by purchasing fractions of high-value assets.

- Diverse Portfolio: Fractional ownership enables investors to diversify their portfolios across multiple NFTs, spreading risk and potential returns.

Risks and Considerations

While NFT fractionalization offers numerous benefits, it also comes with certain risks and considerations:

- Regulatory Uncertainty: The regulatory landscape for fractional NFTs is still evolving. Investors need to stay informed about legal developments to ensure compliance.

- Market Volatility: The NFT market is known for its volatility. Fractional NFTs are subject to the same market fluctuations as whole NFTs, which can impact their value.

- Custodial Risks: The security of fractional NFTs depends on the underlying smart contracts and platforms. Investors should conduct thorough due diligence before investing.

NFT fractionalization represents a significant advancement in the digital collectibles market, unlocking liquidity and making high-value assets accessible to a broader audience. By leveraging smart contracts and blockchain technology, fractionalization enhances market participation, fosters community engagement, and democratizes investment opportunities in art and gaming.

As the NFT ecosystem continues to evolve, staying informed and adaptable will be crucial for investors seeking to capitalize on the potential of NFT fractionalization.

Want to learn more about the exciting world of NFT fractionalization and how to leverage it for your investment strategy? Set up a consultation with the experienced digital asset consultants at Kenson Investments. The company specializes in providing digital asset investment solutions and consulting on NFTs and digital collectibles. The firm’s expertise helps clients enhance their investment strategies and manage risks effectively.

Reach out to their consultants at 1.800.970.2506 for more information.

About the Author

Sarah R. is a seasoned financial analyst and blockchain expert with over half a decade of experience in the digital asset industry. She specializes in NFT strategies and fractionalization, providing advanced insights to help investors maximize returns. Sarah holds a master’s degree in finance and is a certified financial planner (CFP).

Disclaimer: The content provided on this blog is for informational purposes only and should not be construed as financial advice. The information presented herein is based on personal opinions and experiences, and it may not be suitable for your individual financial situation. We strongly recommend consulting with a qualified financial advisor or professional before making any financial decisions. Any actions you take based on the information from this blog are at your own risk.

Randal Daly has been following the crypto space since 2024. He is a passionate advocate for blockchain technology, and believes that it will have a profound impact on how people live their lives. In addition to being an avid blogger, Randal also enjoys writing about developments in the industry as well as providing useful guides to help those who are new to this exciting frontier of finance and technology.