Cryptocurrency has revolutionized the financial world, offering investors new ways to build wealth. Whether you’re a beginner or an experienced investor, understanding crypto investing is essential. In this guide, LessInvest.com provides a comprehensive overview of how to get started, the best investment strategies, and how to manage risks effectively.

Content

Understanding Cryptocurrency Basics

What is Cryptocurrency?

A cryptocurrency is a digital asset that operates on blockchain technology, ensuring secure and decentralized transactions. Unlike traditional currencies, cryptocurrencies are not controlled by a central authority, making them resistant to government intervention.

Types of Cryptocurrencies

There are thousands of cryptocurrencies, but the most well-known include:

- Bitcoin (BTC): The first and most valuable cryptocurrency.

- Ethereum (ETH): Known for its smart contract functionality.

- Ripple (XRP): Used primarily for cross-border payments.

- Litecoin (LTC): A faster, more scalable version of Bitcoin.

Investors should research and analyze different crypto investing options to determine the best fit for their portfolio.

How Blockchain Works

Blockchain technology is the foundation of cryptocurrency. It is a distributed ledger that records transactions securely and transparently. Key features of blockchain technology include:

- Decentralization: No single authority controls the network.

- Transparency: Every transaction is recorded publicly.

- Security: Advanced cryptographic techniques prevent fraud.

Understanding blockchain technology helps investors make informed decisions when exploring crypto investing opportunities.

Getting Started with Crypto Investing

Step 1: Choose a Cryptocurrency Exchange

To buy and trade cryptocurrencies, you need a reputable exchange. Popular platforms include:

- Binance

- Coinbase

- Kraken

- LessInvest.com crypto resources

Compare fees, security, and supported coins before selecting an exchange.

Step 2: Secure a Crypto Wallet

A crypto wallet stores your digital assets. There are two types:

- Hot Wallets: Online wallets that are convenient but vulnerable to hacks.

- Cold Wallets: Offline wallets that provide higher security.

Using a secure crypto wallet is essential for protecting your investments.

Step 3: Fund Your Account

Before purchasing cryptocurrency, you need to deposit funds into your exchange account. Most platforms accept:

- Bank transfers

- Credit/debit cards

- Stablecoins like USDT

Ensure you understand deposit fees and processing times.

Step 4: Make Your First Crypto Investment

Once your account is funded, you can buy cryptocurrency. Start small, diversify, and use strategies like dollar-cost averaging (DCA) to reduce market risk.

Crypto Investment Strategies

Long-Term Holding (HODL)

HODLing involves buying cryptocurrency and holding it for an extended period, regardless of short-term price fluctuations. Investors believe that certain coins will increase in value over time.

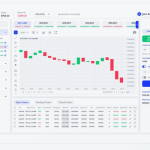

Day Trading

Day traders buy and sell cryptocurrency within a single day to take advantage of price movements. This strategy requires market analysis and experience.

Staking and Yield Farming

Staking involves locking up cryptocurrency in a blockchain network to earn rewards, while yield farming provides interest-like returns for lending digital assets.

Diversification

Never put all your money into one cryptocurrency. Instead, spread investments across different assets to minimize risk and maximize potential returns.

Using LessInvest.com Invest Resources

LessInvest.com invest tools provide insights, trend analysis, and expert advice to help investors make smarter decisions.

Managing Risks in Crypto Investing

Understanding Volatility

The cryptocurrency market is highly volatile. Prices can rise or fall dramatically in short periods. To manage risk:

- Invest only what you can afford to lose.

- Use stop-loss orders to minimize losses.

- Stay updated with market trends.

Security Measures

Protect your investments by:

- Using cold wallets for long-term storage.

- Enabling two-factor authentication (2FA).

- Avoiding phishing scams and fraudulent websites.

Regulatory Risks

Governments worldwide are implementing regulations on crypto investing. Stay informed about legal changes in your country to ensure compliance.

Emotional Control

Many investors lose money due to emotional decisions. Stick to your investment strategy, avoid panic selling, and focus on long-term gains.

Conclusion

Crypto investing offers immense opportunities, but it also comes with risks. By understanding blockchain technology, using crypto wallets, and applying smart investment strategies, you can navigate the market confidently. LessInvest provides expert guidance and resources to help you make informed investment decisions.

FAQs

What is Cryptocurrency?

A digital currency using blockchain technology to enable secure transactions without a central authority.

How Do I Invest in Cryptocurrency?

You can start by signing up on an exchange like LessInvest.com crypto, funding your account, and purchasing digital assets.

What Are the Different Ways to Invest in Crypto?

You can buy and hold, trade, stake, or participate in yield farming.

What Are the Risks of Investing in Crypto?

The cryptocurrency market is volatile, with risks including hacking, regulatory changes, and emotional investing.

How Much Should I Invest?

Invest only what you can afford to lose. Start small and increase your investment as you gain experience.

How Do I Choose a Cryptocurrency to Invest In?

Research factors like market capitalization, use case, development team, and long-term potential.

Where Do I Store My Cryptocurrency?

Use a crypto wallet, either a hot wallet for frequent trading or a cold wallet for security.

Randal Daly has been following the crypto space since 2024. He is a passionate advocate for blockchain technology, and believes that it will have a profound impact on how people live their lives. In addition to being an avid blogger, Randal also enjoys writing about developments in the industry as well as providing useful guides to help those who are new to this exciting frontier of finance and technology.