The decentralized finance (DeFi) space has rapidly evolved into one of the most exciting and disruptive sectors in the world of finance. With the rise of blockchain technology, traditional finance systems are being challenged by decentralized alternatives, offering users the opportunity to lend, borrow, and trade without relying on intermediaries. Aave has positioned itself as a dominant player in this space, making a significant impact on the DeFi ecosystem. In this article, we will explore Aave’s DeFi market share, its role within the DeFi lending market, and its market share. We will also discuss the factors behind Aave’s success and its future outlook.

Content

The Role of Aave in the DeFi Ecosystem

DeFi has disrupted traditional finance by enabling financial services through decentralized protocols, offering greater accessibility, security, and transparency. At the heart of this movement is Aave, a decentralized lending platform that allows users to borrow and lend cryptocurrencies without relying on central authorities like banks. Aave operates on the Ethereum blockchain and leverages smart contracts to automate lending and borrowing processes.

Since its inception, Aave has grown to become one of the largest and most influential platforms in the DeFi space. It has played a vital role in reshaping how users interact with financial services, creating a marketplace that is open to anyone, anywhere. With its innovative features such as flash loans, collateral swaps, and variable interest rate options, Aave has attracted a significant portion of the total DeFi market share.

Aave’s Market Share in DeFi Lending

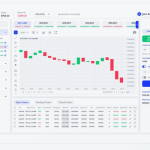

Aave has been a major player in the DeFi lending market, with its protocol accounting for a large portion of the market’s total value locked (TVL). Aave holds an impressive 45% market share in DeFi lending, making it one of the leading platforms in the sector. This dominance is a testament to the platform’s popularity and the trust it has earned from its users.

In comparison to other decentralized lending platforms like Compound, MakerDAO, and Yearn Finance, Aave’s DeFi lending market share continues to grow. Aave’s key advantages, such as competitive interest rates, a wide range of supported assets, and user-friendly interface, have helped it attract a diverse user base. Additionally, Aave’s security features, which include a robust risk management protocol and insurance funds, have further solidified its position as a trusted leader in the space.

Aave’s ability to offer lending and borrowing services in both stablecoins and volatile assets sets it apart from its competitors. This flexibility appeals to a broad range of users, from those looking for low-risk lending opportunities to those seeking higher yields in more volatile markets. This diverse offering has contributed significantly to Aave’s dominance in the DeFi lending market.

How Aave Maintains Its Market Dominance

There are several key factors that contribute to Aave’s ability to maintain its DeFi market share. One of the most significant factors is the platform’s constant innovation. Aave has consistently introduced new features that differentiate it from other DeFi protocols. For instance, Aave introduced the Aave V3 upgrade, which includes features like Gas Optimization and Cross-Chain Lending, enhancing the efficiency and functionality of the platform. This version of Aave offers improved scalability, which is critical in maintaining its leadership position as DeFi adoption continues to grow.

Additionally, Aave’s DeFi dominance can be attributed to its focus on security and governance. Aave’s decentralized governance model allows its users to vote on important protocol upgrades, ensuring that the platform remains responsive to the needs of its community. The platform also benefits from an insurance fund, which provides protection against losses in the event of a protocol exploit. This commitment to user safety and governance has earned Aave the trust of both retail and institutional investors.

The community-driven nature of Aave’s protocol has fostered loyalty among its users. As a result, Aave has become more than just a lending platform—it has become a community-driven ecosystem. This connection with users has proven to be a powerful tool in retaining market share and building long-term growth.

Aave’s Influence on the Broader DeFi Ecosystem

Beyond its market share in DeFi lending, Aave’s influence extends throughout the entire DeFi ecosystem. The protocol has played a pivotal role in advancing the overall development of decentralized finance. Aave’s liquidity pools serve as the backbone of many other DeFi projects, providing the necessary capital for decentralized exchanges (DEXs), liquidity pools, and other financial products.

One of Aave’s most notable contributions to the DeFi ecosystem market share is its collaboration with other DeFi projects. By offering its liquidity to other platforms, Aave has become an integral part of the decentralized finance landscape. Additionally, Aave’s support for Layer-2 scaling solutions like Optimism and Arbitrum has helped improve transaction efficiency, reduce gas fees, and make the platform more accessible to users worldwide.

Moreover, Aave’s pioneering role in flash loans has spurred innovation within the DeFi space. Flash loans allow users to borrow funds without collateral, provided they are repaid within the same transaction. This unique feature has opened new opportunities for arbitrage, liquidity provision, and decentralized applications (dApps), making Aave a key player in the evolution of decentralized finance.

The Future of Aave’s Market Share

Looking forward, Aave is well-positioned to continue leading the DeFi lending market. With the ongoing development of new features, the platform’s DeFi lending protocol market share is expected to grow, particularly as the DeFi space becomes more mainstream. Aave’s focus on improving scalability, user experience, and security will likely keep it at the forefront of the DeFi ecosystem.

The future also holds exciting opportunities for Aave to expand beyond Ethereum and integrate with other blockchain networks. By supporting multi-chain functionality, Aave could tap into new markets and increase its share of the overall DeFi lending ecosystem market share.

However, Aave must navigate several challenges to maintain its DeFi market share. One of the biggest challenges is competition from other DeFi protocols that are continuously innovating. In addition, regulatory scrutiny of DeFi platforms is on the rise, and Aave will need to adapt to any changes in the regulatory landscape to ensure its continued success.

Despite these challenges, Aave’s strong foundation and commitment to innovation make it one of the most promising platforms in the DeFi space. As the DeFi sector matures, Aave is expected to remain a leader, continually evolving to meet the needs of its users.

Conclusion

Aave’s market share in DeFi lending is a testament to its success in the decentralized finance space. With a solid foundation of innovation, security, and community engagement, Aave has positioned itself as a leader in the industry. As Aave’s DeFi market share continues to grow, the protocol will remain at the heart of the DeFi ecosystem and its broader market dynamics.

The protocol’s ability to offer competitive interest rates, expand its offering through new features, and foster a strong community-driven ecosystem has been instrumental in its success. Looking ahead, Aave is well-positioned to maintain its DeFi dominance, continuing to provide users with innovative financial products in a decentralized world.

As Aave continues to evolve, its role in shaping the future of DeFi and its market share will only increase. Investors, users, and industry participants should keep a close eye on Aave, as it is poised to remain a key player in the ever-growing DeFi lending market.

FAQs

What is Aave’s market share in DeFi lending?

Aave holds a significant 45% market share in DeFi lending as of, making it one of the leading platforms in the decentralized finance space.

How does Aave maintain its dominance in DeFi?

Aave maintains its dominance through constant innovation, such as the Aave V3 upgrade, strong community governance, and robust security features like insurance funds.

Randal Daly has been following the crypto space since 2024. He is a passionate advocate for blockchain technology, and believes that it will have a profound impact on how people live their lives. In addition to being an avid blogger, Randal also enjoys writing about developments in the industry as well as providing useful guides to help those who are new to this exciting frontier of finance and technology.