The best Bitcoin miner for 2025 is the Bitmain Antminer S19 Pro, due to its high hash rate (110 TH/s), energy efficiency (29.5 J/TH), and profitability. Other top contenders include the WhatsMiner M30S++ and AvalonMiner 1246, offering competitive mining performance. Choosing the right miner depends on power efficiency, hash rate, and return on investment (ROI).

Bitcoin mining has become increasingly competitive as mining difficulty rises. Success depends on selecting the best Bitcoin miner, optimizing operational costs, and staying updated with market trends. This guide explores top Bitcoin miners, essential features, mining strategies, and future industry predictions.

Content

Understanding Bitcoin Mining and Its Importance

Bitcoin mining is the process of validating transactions and adding them to the Bitcoin blockchain. Miners use high-powered computers to solve cryptographic puzzles, ensuring the security and integrity of the network. In return, they receive mining rewards, which currently stand at 6.25 BTC per block.

The profitability of crypto mining depends on several factors, including mining hardware, electricity costs, and Bitcoin’s market value. Since mining difficulty adjusts every 2,016 blocks, efficient hardware is crucial for sustained earnings.

Top Bitcoin Miners for 2025

Choosing the best Bitcoin miner involves comparing hardware based on hash rate, power efficiency, and overall profitability. Below are the top mining machines for 2025:

Bitmain Antminer S19 Pro

- Hash Rate: 110 TH/s

- Power Consumption: 3250W

- Efficiency: 29.5 J/TH

- Pros: High hash rate, low power consumption

- Cons: Expensive initial cost

WhatsMiner M30S++

- Hash Rate: 112 TH/s

- Power Consumption: 3472W

- Efficiency: 31 J/TH

- Pros: Excellent performance, robust design

- Cons: Higher energy consumption

AvalonMiner 1246

- Hash Rate: 90 TH/s

- Power Consumption: 3420W

- Efficiency: 38 J/TH

- Pros: Durable and reliable

- Cons: Lower efficiency compared to competitors

Each of these mining rigs offers different advantages based on operational costs and profitability.

Key Factors When Choosing a Bitcoin Miner

Selecting the right Bitcoin miner requires evaluating the following:

Hash Rate

The hash rate determines the processing power of a miner. A higher hash rate means more calculations per second, increasing the chances of mining a block. Crypto mining efficiency depends on maximizing hash rate while keeping power consumption low.

Power Efficiency

Mining hardware consumes significant electricity. Energy-efficient miners like the Antminer S19 Pro reduce operational costs, making them more profitable over time.

Hardware Cost vs. ROI

Miners must balance the upfront cost of hardware with potential earnings. Calculating cryptocurrency investment returns helps determine whether a miner is worth the investment.

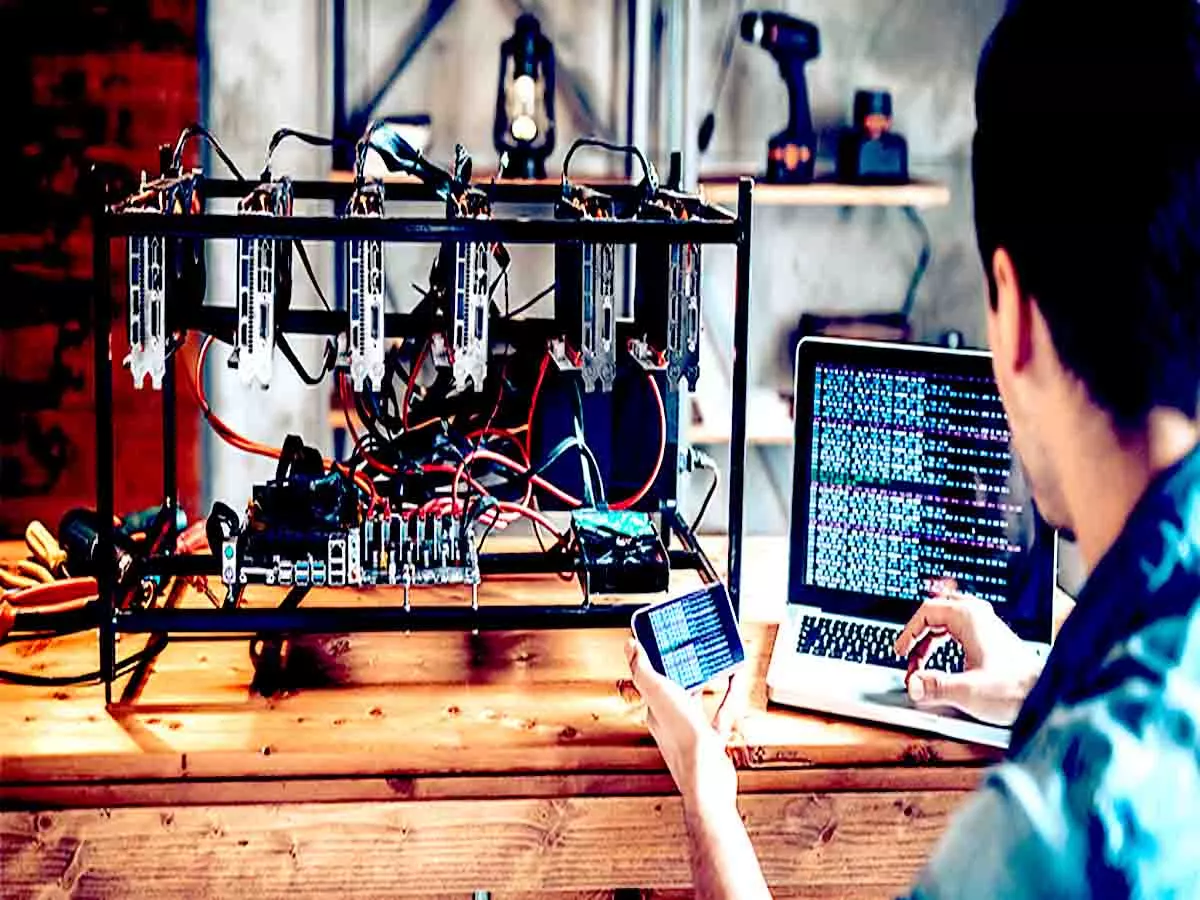

Setting Up a Profitable Bitcoin Mining Operation

A successful mining operation requires careful planning. Key considerations include:

Selecting the Right Location

Mining is most profitable in regions with cheap electricity. Some areas offer government incentives for crypto mining, further reducing costs.

Joining a Mining Pool

Solo mining is difficult due to competition. Pooling resources in a cryptocurrency mining pool increases the likelihood of earning consistent rewards. Leading mining pools include F2Pool, Slush Pool, and Antpool.

Optimizing Cooling and Ventilation

Mining hardware generates immense heat. Efficient cooling systems, including air-cooling and immersion cooling, extend hardware lifespan and maintain stable performance.

Cloud Mining vs. Hardware Mining

Cloud Mining

For those unable to invest in expensive mining rigs, cloud mining provides an alternative. It involves renting mining power from remote data centers.

- Pros: No hardware maintenance, lower entry costs

- Cons: Less control, potential for scams

Hardware Mining

Owning crypto mining hardware offers full control over operations and profits. While initial costs are higher, long-term earnings can be substantial.

Storing and Managing Mined Bitcoin

After mining Bitcoin, proper storage is essential to ensure security. Using a crypto wallet protects assets from theft and cyber threats.

Best Crypto Wallets for Miners

- Ledger Nano X – A secure hardware wallet with multi-signature support.

- Trezor Model T – Provides advanced security features for storing cryptocurrency.

- MetaMask – A popular software wallet for managing crypto investments.

Cold storage solutions like hardware wallets offer the highest level of security.

Selling and Trading Bitcoin for Maximum Gains

Once Bitcoin is mined, selling and trading it strategically maximizes profits. Choosing a reputable cryptocurrency exchange is essential for safe transactions.

Best Cryptocurrency Exchanges

- Binance – Low trading fees and high liquidity.

- Coinbase – Ideal for beginners with a user-friendly interface.

- Kraken – Advanced security and trading tools.

Engaging in cryptocurrency trading requires understanding market trends and using technical analysis to optimize buying and selling decisions.

Future Trends in Bitcoin Mining

As Bitcoin mining evolves, several trends will shape the industry:

Increased Energy Efficiency

Manufacturers are focusing on developing more energy-efficient mining rigs. Future crypto mining hardware will consume less power while delivering higher hash rates.

AI-Driven Optimization

Artificial intelligence (AI) is expected to enhance mining operations by optimizing power usage and predicting profitability trends.

Regulatory Changes

Governments worldwide are considering stricter regulations on cryptocurrency mining. Staying informed about legal developments is crucial for miners.

Conclusion

Choosing the best Bitcoin miner in 2025 requires a balance between performance, power efficiency, and cost. The Antminer S19 Pro, WhatsMiner M30S++, and AvalonMiner 1246 stand out as top contenders. Whether opting for hardware mining or exploring cloud mining, success depends on optimizing strategies, securing mined Bitcoin with a crypto wallet, and leveraging profitable cryptocurrency trading opportunities.

FAQs

How much does a Bitcoin miner cost?

Bitcoin miners range from $2,000 to $10,000, depending on the model and efficiency. High-end miners like the WhatsMiner M30S++ have higher upfront costs.

What is the most energy-efficient Bitcoin miner?

The Antminer S19 Pro is one of the most energy-efficient miners, consuming 3250W while delivering a hash rate of 110 TH/s, optimizing power usage.

What is cloud mining, and is it worth it?

Cloud mining allows users to rent mining power without owning hardware. While convenient, it often has lower returns compared to hardware mining.

How long does it take to mine 1 Bitcoin?

With top mining hardware, it takes about 10 minutes to mine 1 BTC, but solo mining is difficult. Most miners rely on mining pools for consistent rewards.

Randal Daly has been following the crypto space since 2024. He is a passionate advocate for blockchain technology, and believes that it will have a profound impact on how people live their lives. In addition to being an avid blogger, Randal also enjoys writing about developments in the industry as well as providing useful guides to help those who are new to this exciting frontier of finance and technology.